You have never managed your money any easier in the UAE. First Abu Dhabi Bank (FAB) is one of the largest and most reliable banks in the country, offering an easy and secure way to open a bank account online. Regardless of being an expat, resident, student, or business owner, FAB digital banking services can support you in getting your account ready within a short time and with little effort since you do not need to visit one of the branches to complete your task.

We discuss all that you must know about opening your FAB Bank Online Account in this guide, including steps, requirements, benefits, and safety tips.

Why Choose FAB Bank in the UAE?

FAB is a reputable banking organization that has millions of customers in Dubai, Abu Dhabi, Sharjah, Ajman, Al Ain, and Ras Al Khaimah. The bank offers:

- Current accounts deal with transactions of the day.

- Life Insurance to expand on your money safely.

- Immediate salary credit notifications on salary accounts.

- Small and medium enterprise business.

It is now even easier to manage your money with the digital-first solutions such as the FAB Mobile App and Online Banking.

Documents Required for Online Account Opening

Documents Required for Online Account Opening

Emirates ID:

This is your official identification verification, and every resident of the UAE is obliged to carry it.

Passport Copy:

Expatriates will need a copy of their passport, which will identify their nationality and personal information.

UAE Residency Visa:

Supplies as evidence of your legal stay in the UA are a necessity with regard to account verification.

Salary Certificate or Employment Letter:

You were required to confirm that you are employed and opening a salary account.

Proof of Address:

Paperwork such as a utility bill, tenancy contract, or a bank statement ensures your present residential location.

Step-by-Step Guide to Open a FAB Bank Account Online

It is easy to open a FAB account online. Follow these steps:

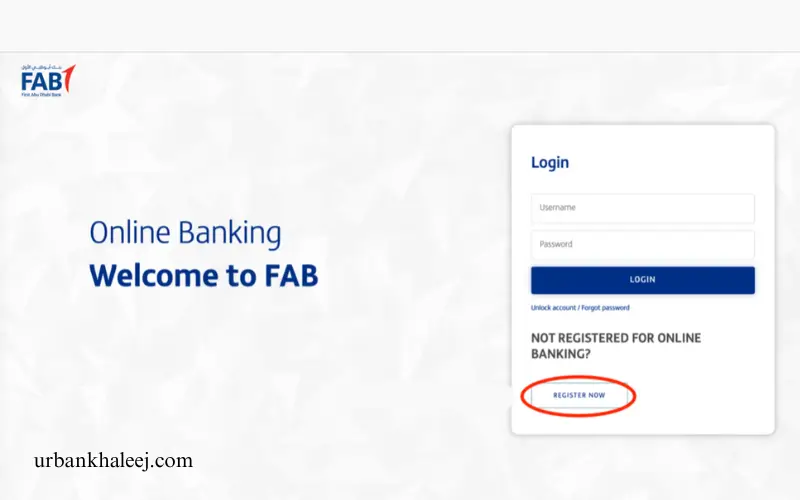

Step 1: Go to the FAB Website.

Enter the site of bankfab.com and open an account online.

Step 2: Select Your Account Type.

Choose the type of account that fits your needs: current, savings, salary, or business account.

Step 3: Complete the Web Application.

Fill in your personal information, contact details, and your employment details in the safe online form.

Step 4: Post Necessary Documentation.

Provide your Emirates ID, passport, visa, salary certificate, and evidence of address.

Step 5: Full KYC Checking.

Authenticate by using UAE Pass or a video KYC call. It passes on the AML and KYC requirements that could require FAB to seek more information.

Step 6: Accept Your Account Disclosure.

Upon approval, your account number, IBA, N, and debit card details will be sent to you digitally or through mail.

Benefits of Opening a FAB Account Online

| Benefit | Description |

| Fast and Convenient | Open your account anytime, anywhere in the AE |

| Secure | OTP and UAE Pass verification protect your information |

| Digital Banking | Access the FAB Mobile App and Online Banking instantly |

| Salary Ready | Compatible with salary deposits and Ratibi cards |

| 24/7 Support | Customer care assistance across all UAE cities |

FAB Mobile App Features After Account Opening

The FAB Mobile App lets you:

- Real-time balances of your account

- Instantly receive salary notifications

- Transfer money locally or internationally.

- Online bill payment for utilities and bills

- Log in securely with UAE Pass

Online Account Security Tips

To ensure your FAB account remains safe:

- Secure Wi-Fi and mobile networks

- Do not share your UAE Pass or OTP with anyone else

- After using public computers, log out.

- Use strong, unique passwords

- Regularly update the FAB App to ensure security

The FAB Online account works best in these locations

FAB Online Account Services are now available in all major UAE Cities:

- Dubai

- Abu Dhabi

- Sharjah

- Ajman

- Al Ain

- Ras Al Khaimah

You can open a bank account in any branch of the UAE without having to visit a physical location.

Conclusion:

It’s easier than ever to open a FAB Bank online account in the UAE. Manage your finances with ease thanks to the FAB Mobile App and Online Banking.

You can manage your finances online, including tracking salary deposits, paying bills, and transferring funds from anywhere. Following the steps in this guide and keeping account details secure, I’ll allow you to enjoy seamless banking with First Abu Dhabi Bank.

FAQ’s

Q1: Can expats in the UAE open an online FAB account?

Expats are able to open an account with FAB online by using their Emirates ID, UAE residence visa, and passport. It is a simple process that can be done digitally.

Q2: How can I get a FAB account online?

FAB offers a mobile or website app that allows you to open an account for a business, severance account, current account, or savings account.

Q3: What is the time required to open an online FAB account?

Usually, the account will be approved in 24-48 hours following KYC verification.

Q4: Is it necessary to go to a branch to open a bank account?

Most of the process for opening a new account can be completed online. Only if you need additional verification will you have to go into a branch.

Q5: Is it possible to get a card immediately?

The FAB Mobile App offers a digital debit card immediately. Physical cards are delivered within days to your home.

Q6: What is the best way to verify your identity online?

You can verify using UAE Pass or by video calling FAB Customer Support.

Q7: Can I upload my documents to open a FAB online account?

FAB protects your information using encrypted systems, such as UAE Pass.

Q8. Can I open an FAB account for my salary without having a letter from the company?

For salary accounts, you will need a letter of employment or a certificate. However, some packages for expats may accept alternative forms of verification.

Q9: How quickly can I access my online account?

Once your account has been approved, yes, you will be able to access the FAB Mobile App as well as Online Banking in order to make transactions, transfer funds, or pay bills.

Q10: Is there a charge for opening an online FAB account?

The majority of accounts are free to open online; however, some may charge monthly fees depending on account type.